LEVERAGING Digital Innovations to Drive Financial Inclusion in NIGERIA

JUNE 6-7, 2023

LAGOS, NIGERIA

IN NUMBERS

Pre-Qualified

Delegates

Leading

Organisations

Industry

Speakers

Solution

Providers

#WFISNIGERIA

With Nigeria housing the largest population in the MEA region of which 65% are under 35 years, it has got the best ingredients for the growth of fintech. About 250 fintech companies are already leveraging on the country’s 187 million mobile connections, where an internet penetration rate of 51% is further bolstering the industry.

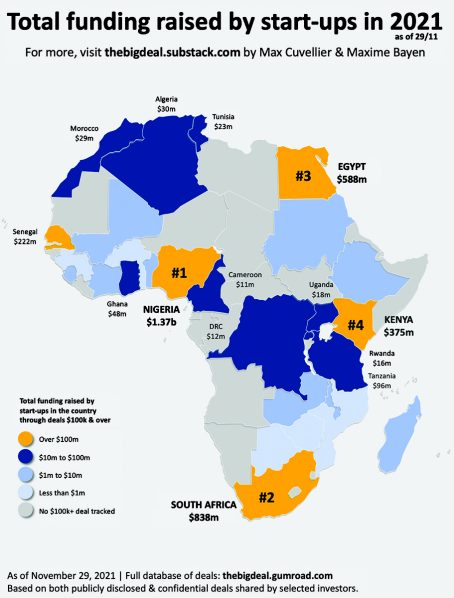

As the leading fintech player in the continent, Nigeria garnered $1.37 billion out of the $4 billion funding raised in Africa, where the country’s fintech operators accounted for 63%. In the quest to advance the potential of the country’s payments system with the objective of making it seamless and accessible for all Nigerians, the Central Bank of Nigeria has even launched Central Bank Digital Currency (CBDC) called eNaira.

Paying heed to the situation and thereby providing a common platform for the burgeoning FSI & Tech community, Tradepass is hosting World Financial Innovation Series (WFIS) in Nigeria on 6 – 7 June 2023. The event will host over 500 technology and business heads from the leading Banks, Insurance & Micro-Finance institutions across the country

A QUICK INSIGHT ON NIGERIA'S FSI MARKET

64M

Unbanked people in Nigeria

250+

Fintech companies in Nigeria

51%

Population with internet access

187M

Mobile connections in Nigeria

CONFERENCE

Presenting the top inspiring names from the industry at the main stage to share crucial intelligence on the most pressing topics, which gets further enriched by a Q&A session.

It showcases thought leadership and cutting-edge knowledge for the growth of the entire business community. A perfect platform that projects the pulse of the industry.

EXHIBITION

Enabling the organisations to showcase their best to the many pre-qualified delegates at the event in real-time. The provision of using technology just adds on to the whole demonstration and helps in driving more leads from the top companies across the industry.

It’s specifically tailored for the organizations to get in the eyes of the region’s biggest stakeholders and uplift their overall brand image.

AFTER HOURS

An exclusive session for more networking exposure, allowing attendees to break the ice with some spirit-lifting humour, while enabling them to unwind and rub shoulders against industry peers, thought leaders, and potential customers.

Allowing networking interactions to happen in a more relaxed and honest way, where receiving direct feedbacks is a given phenomenon.

Delivering Financial Inclusion through Innovations

CBDCs Foundation of a new monetary architecture

Securing the Cyberspace Tackling evolving cyberthreats

Banking on AI Role of Hyper-automated Banks

Cloud Banking Driving Agility with Fastened Service Delivery

Digital Payments Revolution Crossing the Borders Beyond Countries

Building on The Power of APIs and Open Banking

Digital CX Through Cutting-Edge Tech Solutions

Speakers

BABATUNDE

OBRIMAH

Chief Operating Officer

FINTECH ASSOCIATION OF NIGERIA

ADEOLUWA

AKOMOLAFE

Chief Information Officer

WEMA BANK PLC

FATAI

TELLA

Chief Data Officer

STERLING BANK PLC

FEMI G

ADERIBIGBE

Chief Information & Digital Officer

GREENWICH MERCHANT BANK

VIRGINIE

NOWAK

Group Chief Customer Experience Officer

ACCESS BANK

ADEWALE

SALAMI

Chief Technology Officer

First Bank Nigeria

OLUFEMI

OLOFINTILA

CISO

Nova Merchant Bank

ECHEZONA

AGUBATA

Head, IT Governance and Strategy

Union Bank of Nigeria

WASIU

POPOOLA

Chief Digital & Innovation Officer

Parallex Bank

Demographics

BY JOB TITLES

19%

9%

11%

15%

10%

8%

9%

2%

17%

.jpg)

.jpg)

.jpg)